What Is the Upgrades/Downgrades Feature, and How Do I Use It?

Upgrades/Downgrades can help investors find stocks that have been upgraded to Buy or Strong Buy in the Quant rating, SA Analysts rating, or Wall Street rating. You can view this data for the past 30 days.

This feature can be found under the PRO section.

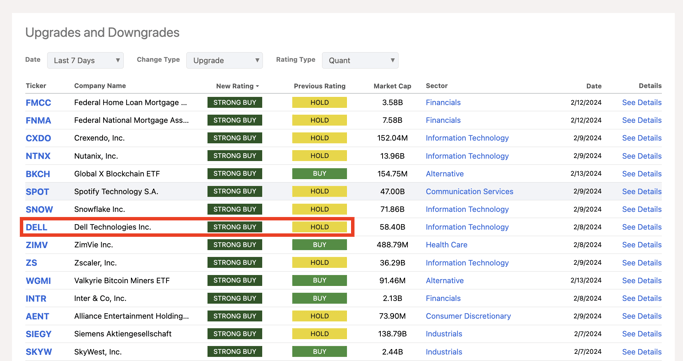

On the Upgrades/Downgrades dashboard, you can view upgrades and downgrades for each of the three ratings, i.e., the Sell-Side (Wall Street Analysts) rating, the Seeking Alpha Analysts rating, and the Quant rating.

You can select the Date range (Last Day, Last 7 Days, or Last 30 Days), Change Type (Upgrade/Downgrade), and Rating Type (Quant, SA Analysts, or Wall Street).

In the example below, the filter is set to display upgrade ratings changes for the last 7 days for Quant ratings only. We can see that DELL’s Quant rating has jumped from "Hold" to "Strong Buy."

Based on this information, you might use this as a springboard to perform further analysis on this stock, such as looking into the company’s financials on the symbol page or comparing this stock to others using the Key Stats Comparison tool.

Upgrades/Downgrades can also be found in your portfolio and serves as a really valuable risk management tool.

Every day when you sign into your account, you can jump to this tool and see if any of your stocks’ ratings have changed.

If a stock has been downgraded, you might consider selling the stock and removing it from your portfolio. Inversely, if a stock has been upgraded, you might want to consider doubling down on that position.

Additionally, we’ve included Upgrades/Downgrades to the daily portfolio summary email, enhancing the real-time, track my stocks experience for PRO subscribers.

Please email us at subscriptions@seekingalpha.com if you need any help.

If you haven't subscribed to PRO yet, you can unlock access to our subscriber-only features by signing up here.